When people talk about investing in precious metals, gold bars for sale and buy silver rounds are often at the top of the list. They’re simple, timeless, and trusted for preserving wealth during uncertain times. Unlike paper money, they hold real, tangible value.

Today, investors are again turning toward physical gold and silver because of inflation, global tension, and market unpredictability. But here’s the thing—buying precious metals isn’t just about picking something shiny. It’s about understanding the market, knowing who you’re buying from, and getting real value for your money.

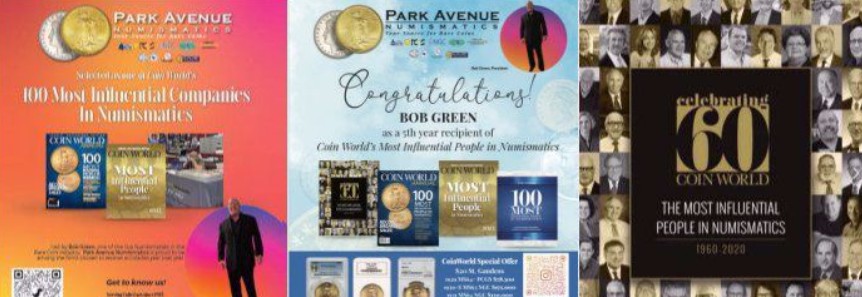

That’s where Park Avenue Numismatics steps in. Founded in 1988, the company is a trusted leader in rare coins, gold, and silver investments. They’ve built their name on experience, trust, and customer satisfaction. You can explore their full collection at https://www.parkavenumis.com.

Let’s break down what makes buying gold bars and silver rounds smart, what to watch for, and how to do it safely.

What Makes Gold Bars a Smart Buy

Gold has always been the symbol of stability and security. When stock markets drop or inflation rises, gold tends to hold its ground. It’s been this way for centuries.

Gold bars are one of the purest ways to own physical gold. They’re available in many sizes—from small 1-gram pieces to large 1-kilogram bars. For new investors, smaller bars are often more affordable and easier to sell later.

Buying gold bars for sale gives you a direct stake in physical gold, not a paper promise. It’s a simple, long-term way to protect your wealth.

When you buy from a reliable source like Park Avenue Numismatics, you can trust that every gold bar is certified for purity and authenticity. They only sell investment-grade gold from respected mints like PAMP Suisse, Credit Suisse, and the Royal Canadian Mint.

Gold bars also come with serial numbers and certificates, adding an extra layer of security. This makes them easy to verify and resell when the time comes.

Why Silver Rounds Are Worth Considering

While gold gets most of the attention, silver has its own charm. It’s affordable, easy to buy in bulk, and often performs strongly during times of economic recovery.

When people say buy silver rounds, they’re referring to silver coins without face value—made purely for investment. They look like coins but are valued by weight, not by any government backing.

Silver rounds are available in various designs, from classic American Eagle patterns to artistic engravings. This makes them popular not just among investors but also among collectors.

Silver also has huge industrial demand—in electronics, solar panels, and medicine. So, unlike gold, it has both investment and practical uses.

When you buy silver rounds from Park Avenue Numismatics, you’re not just buying metal—you’re buying assurance. Every round is tested for weight and purity, ensuring full transparency.

Key Benefits of Buying Gold Bars and Silver Rounds

Investing in precious metals offers several advantages that paper-based assets simply can’t.

First, gold and silver are tangible. You can hold them, store them, and pass them on. Stocks and bonds may fluctuate wildly, but physical metals remain stable.

Second, they provide inflation protection. When currency loses value, metals usually rise in price. This makes them a practical hedge during economic uncertainty.

Third, they offer global liquidity. You can sell gold and silver almost anywhere in the world. Their value is universally recognized.

Fourth, both metals diversify your portfolio. If your investments are all in digital or financial assets, adding gold or silver balances your risk.

Finally, owning them gives peace of mind. No server crash, cyberattack, or banking issue can erase physical gold or silver from your hands.

The Pros and Cons of Gold and Silver

It’s always wise to understand both sides of an investment.

Gold Pros:

Gold holds its value even in global crises. It’s easy to store and comes in various forms. It’s accepted worldwide and can be easily sold.

Gold Cons:

Gold can be expensive for new investors. Large bars need secure storage, and short-term gains can be limited.

Silver Pros:

Silver is cheaper, allowing entry at lower budgets. It has industrial demand and can sometimes outperform gold in percentage gains.

Silver Cons:

Silver’s price can fluctuate more than gold. It also takes up more storage space for the same dollar value.

By mixing both metals, you can balance these pros and cons. Many smart investors keep a combination of gold bars and silver rounds for this reason.

What to Look for When Buying Precious Metals

Before making your first purchase, you should know what to check.

Authenticity is key. Always buy from a verified dealer who provides purity certificates. Avoid random online sellers or private listings that don’t show proof.

Purity matters. Investment-grade gold should be at least 99.5% pure, and silver rounds should be 99.9% pure. Reputable dealers like Park Avenue Numismatics provide full details with each product.

Pricing transparency is another factor. Trusted sellers will clearly list the spot price (market value) and their small markup. If pricing seems too good to be true, it probably is.

You should also consider storage. Some investors keep metals in home safes, while others use secure vaults or bank deposit boxes. Park Avenue Numismatics offers guidance on storage options to help you protect your assets.

Lastly, check for buyback options. Dealers who offer buyback programs show confidence in the authenticity of their products. Park Avenue Numismatics provides fair market buyback policies, making it easier when you decide to sell.

How Park Avenue Numismatics Helps You Buy Smart

For over three decades, Park Avenue Numismatics has been helping investors build portfolios with gold, silver, and rare coins. Their experts provide personalized advice to fit your goals—whether you’re just starting or expanding a collection.

They don’t pressure you to buy. Instead, they educate you about what you’re purchasing. Each product listing includes detailed specs, high-resolution images, and transparent pricing.

They specialize not only in gold bars and silver rounds but also in collectible coins and certified rarities. Every item is carefully inspected by professionals to meet the highest industry standards.

Visit their website https://www.parkavenumis.com to see current gold bars for sale or to learn how to buy silver rounds confidently.

Real-World Example: A Simple Investment Story

Imagine someone who bought a few gold bars in 2015 when prices were around $1,100 per ounce. By 2025, gold prices hover near $2,400 per ounce. That’s more than double in value over a decade.

Now take silver. Someone who invested in silver rounds at $14 per ounce a few years ago could now see prices around $28 per ounce. That’s steady growth with minimal effort.

Both examples show why gold and silver aren’t just fancy metals—they’re practical assets that can protect your money and grow it over time.

Tips for First-Time Buyers

Start small. Buy one or two smaller bars or rounds to understand the process.

Keep records. Save your receipts, certificates, and storage details. These documents prove authenticity and make resale easier.

Avoid impulse buying. Precious metals can fluctuate, so buy during dips when prices are stable.

Store safely. Use fireproof safes or insured vault services.

Stay informed. Follow metal price trends to decide when to buy or sell.

Are Gold Bars and Silver Rounds Right for You?

That depends on your goals. If you want long-term wealth protection, gold bars are ideal. They’re easy to store, stable, and universally accepted.

If you want something more affordable or wish to trade more frequently, silver rounds are a great pick. They’re flexible and often show stronger short-term growth.

Many investors buy both to balance risk and reward. You can start with small amounts and build over time. The key is consistency and buying from trusted names like Park Avenue Numismatics.

The Honest Verdict

Buying gold bars and silver rounds isn’t about chasing quick profits—it’s about building real financial security. They hold their worth when other assets fail. And in uncertain times, that stability matters most.

However, precious metals shouldn’t replace all your investments. Think of them as a safety net—a smart addition to your portfolio.

By working with an experienced company like Park Avenue Numismatics, you gain expert support, verified products, and fair pricing. Whether you want to explore gold bars for sale or buy silver rounds, their team can help you make confident, informed choices.

So, if you’re ready to invest in something timeless, start by learning, planning, and buying wisely. Gold and silver aren’t just metals—they’re peace of mind in your hands.

More Stories

Party Strippers in Scottsdale: Your Guide to the Best Scottsdale Party Strippers

Vending Machine for Sale: Your Complete Guide to Starting a Profitable Vending Business

Everything You Need to Know About Fire Insurance in Stamford, CT for 2026